Why Sam Altman and Money Are Different

| By TechCrunch – https://www.flickr.com/photos/techcrunch/14092127486/, CC BY 2.0, https://commons.wikimedia.org/w/index.php?curid=136301710 |

When most billionaires talk about money, it’s about luxury, status, or wealth rankings.

Sam Altman is different.

- He doesn’t tweet about cars or mansions.

- He doesn’t glorify money for its own sake.

- He talks about ideas, execution, authenticity, and the uncertainty of the future.

| By Steve Jurvetson – https://www.flickr.com/photos/jurvetson/54446118165/, CC BY 2.0, https://commons.wikimedia.org/w/index.php?curid=164150862 |

Altman has:

- Led Y Combinator, the accelerator that birthed Airbnb, Stripe, Dropbox, Reddit.

- Poured billions into OpenAI, the company behind ChatGPT.

- Launched Worldcoin, a controversial global identity project.

- Been a venture investor in dozens of startups.

And through it all, his philosophy on money has stayed steady:

Money is not about appearances. It’s about adaptation, survival, and creating leverage.

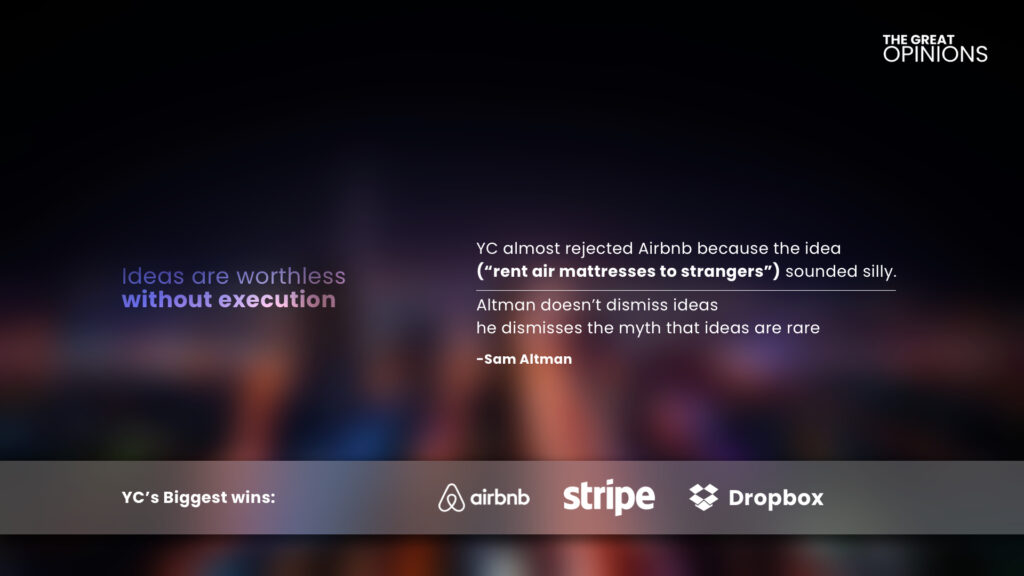

1. Money and Ideas: Execution > Brainstorming

Altman’s first big insight: Ideas are worthless without execution.

At Y Combinator, he saw thousands of founders pitch “the next big thing.”

Most never made it past PowerPoints.

The ones who did?

- Airbnb founders went door-to-door taking photos of hosts’ homes.

- Stripe’s Collison brothers wrote code themselves, onboarding first customers one by one.

- Dropbox hacked virality with a simple demo video.

👉 Execution, not ideas, created billion-dollar outcomes.

Your takeaway:

- Don’t obsess over being “original.”

- Obsess over building, testing, iterating.

- Money doesn’t follow the best idea. It follows the fastest execution.

2. Money and Reality: Humility Over Predictions

Altman said: “The number of times we thought we knew something, to get smacked in the face by reality, has been a lot.”

Even YC, with its top-tier mentors and investors, made bad bets.

- Some startups looked promising → failed fast.

- Others looked silly → turned into unicorns.

Example:

- When Paul Graham, YC’s co-founder, first heard about Airbnb, he thought: “Strangers renting air mattresses? That sounds crazy.”

- Today Airbnb is worth $95 billion+.

👉 Money rewards reality checks, not confidence.

Your takeaway:

- Test fast. Don’t cling to predictions.

- The market decides what’s valuable, not you.

- Build feedback loops that smack you with truth early.

3. Money and AI: The Human Edge

Altman said: “We are hard-wired to care about other people and what they think and do, and we don’t care very much about machines.”

This is counterintuitive.

He runs OpenAI, one of the most powerful AI companies in the world.

But he knows:

- AI can generate infinite content.

- The scarce thing will be authentic humans.

That’s why he bets on identity systems like Worldcoin.

If everyone can fake content, the only valuable thing left will be proven humanity.

👉 Money will flow to:

- Real people with trust.

- Brands that show authenticity.

- Systems that verify identity.

Your takeaway:

- In an AI world, being human is your edge.

- Build communities, not just content.

- Protect your reputation like currency.

4. Money and the Singularity: Betting on the Unknown

Altman said: “We do not know how far beyond human-level intelligence we can go, but we are about to find out.”

Unlike most CEOs, he doesn’t pretend to have all the answers.

He admits: no one knows what happens when AI surpasses us.

But he still bets big.

- Microsoft invested $13 billion into OpenAI.

- ChatGPT hit 100 million users in 2 months — the fastest app adoption in history.

- OpenAI is projected to make $3.4 billion in 2025 revenue.

👉 Altman’s philosophy: the future is uncertain — but you have to play anyway.

Your takeaway:

- Don’t freeze because the future is unclear.

- Place bets, experiment, adapt.

- Money loves bold moves in uncertain times.

5. Money and Identity: Why Being Real Pays

Altman predicts: “Being a real person in a world of unlimited AI content will increase in value.”

That’s the logic behind Worldcoin.

- Users get their iris scanned.

- They receive a “World ID.”

- Goal: create a system that proves who’s human in a world of bots.

Controversial? Yes.

But logical.

If scarcity creates value, then verified humanity could be the new currency.

Your takeaway:

- Double down on authenticity.

- Invest in trust.

- Build things that prove you’re real in a fake-saturated world.

6. Money and Leadership: Admitting No One Has It Figured Out

Altman said: “I think no one has a plan. No one really has it all working smoothly…”

Even top CEOs improvise.

The myth that leaders know everything is dangerous.

Altman leads with honesty:

- Startups are chaos.

- AI is unpredictable.

- Politics is messy.

But leaders win by acting anyway.

Your takeaway:

- Don’t wait for perfect clarity.

- Lead even when things are messy.

- Money rewards those who keep moving.

7. Money and Investments: The Altman Playbook

Beyond YC and OpenAI, Altman has been a sharp investor.

- Invested early in Airbnb, Stripe, Asana, Reddit, Pinterest.

- Backed Helion Energy (fusion power) and Retro Biosciences (longevity).

- Estimated net worth in 2025: $1–1.5 billion.

His strategy?

- Pick massive markets.

- Bet on ambitious founders.

- Focus on future-shaping tech (AI, biotech, energy).

Your takeaway:

- Don’t chase fads.

- Chase fundamentals + huge tailwinds.

- Money compounds in markets that will be 10x bigger in 10 years.

Quick Recap

Here’s the cheat sheet on Sam Altman’s money mindset:

- Execution beats ideas. Ideas don’t pay rent. Execution does.

- Reality smacks. Stay humble. Test fast.

- Humans win. Authenticity is scarce.

- Uncertainty is opportunity. Bet bold. Adapt fast.

- Identity is the new currency. Worldcoin or not, realness pays.

- Leaders improvise. Nobody has a perfect plan.

- Invest big. Pick markets that define the future.

The Orbit Back Home

Sam Altman doesn’t sell “money hacks.”

He sells a mindset.

Money, in his philosophy, isn’t about status.

It’s about:

- Execution.

- Adaptation.

- Authenticity.

- Playing when no one has a map.

And that’s what makes him different.

He’s not just chasing wealth.

He’s reshaping what money means in the age of AI.