Introduction: Why Kunal Shah Matters in Conversations About Money

Most startup stories talk about ideas, funding rounds, and big exits. Kunal Shah’s story is different. His journey is not just about building companies; it’s about building philosophies.

Shah, the founder of FreeCharge and CRED, stands apart because of the way he talks about money, ambition, time, and efficiency. Unlike most founders who celebrate valuation, Shah insists on talking about behaviour. Why do people value status over substance? Why do Indians undervalue their time? Why do mistakes paralyze some people while others use them as fuel?

This philosophical lens has made him a rare voice in India’s startup ecosystem. He doesn’t just build apps. He builds cultures.

So what philosophy led Kunal Shah to achieve what he has today? And more importantly, what lessons can we take from it?

Early Education: Why Philosophy Became His Lens

- Kunal Shah graduated in Philosophy from Wilson College, Mumbai.

- He briefly enrolled in an MBA at NMIMS but dropped out, deciding formal education was not where his answers lay (Wikipedia).

At first glance, this looks odd. Most successful Indian founders have IIT or IIM backgrounds. Shah came from a philosophy degree. Yet this became his edge.

In multiple interviews, Shah has said that philosophy gave him the ability to:

- Ask “why” behind behaviours.

- Spot patterns others miss.

- Think of second-order effects (not just what happens now, but what it leads to later).

This thinking became the foundation of his companies.

First Startup: FreeCharge and the ₹2,800 Crore Lesson

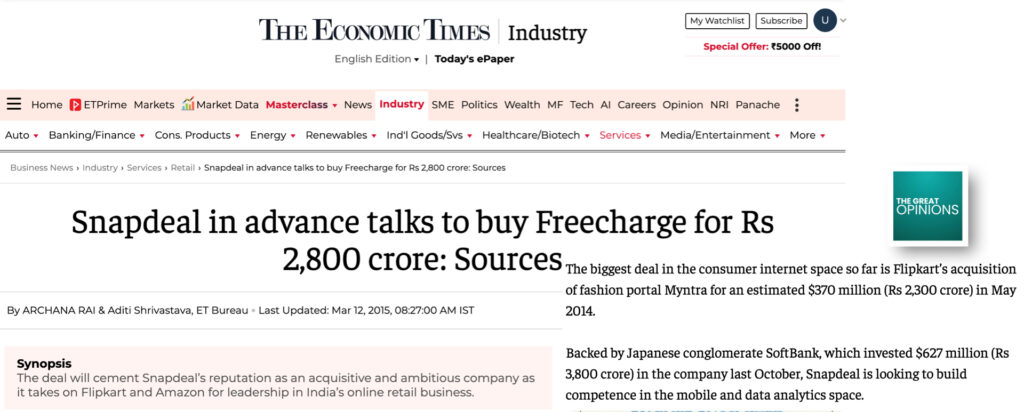

In 2010, Kunal Shah co-founded FreeCharge with Sandeep Tandon. The idea was simple: reward mobile recharges with coupons for popular brands. At the time, recharges were a dull necessity. FreeCharge made them fun.

- Within 5 years, FreeCharge became one of India’s fastest-growing startups.

- In 2015, Snapdeal acquired it for ₹2,800 crore (~USD 400 million) (Wikipedia).

But Shah’s takeaway was not about the money. It was about human behaviour. People love free value. Coupons made recharges sticky.

Yet, Shah also saw the downside: cashbacks and coupons create habit, not loyalty. When the offers stop, so do the customers. This lesson deeply shaped how he approached his second act.

CRED: Betting on Behaviour and Trust

In 2018, Shah launched CRED, a platform that rewards users for paying credit card bills on time.

At first, many laughed. Why build a startup for the top 1%? Why target creditworthy users only?

But Shah’s philosophy was clear:

- Good behaviour deserves to be rewarded.

- India lacked trust-based systems. CRED could be the start.

The gamble worked.

- By 2022, CRED was valued at USD 6.4 billion (Wikipedia).

- In FY24, CRED’s revenue grew 66% YoY to ₹2,473 crore. Losses narrowed significantly.

- In 2025, CRED raised USD 75 million at USD 3.5 billion valuation , lower than the 2022 peak, but with stronger fundamentals (Forbes India).

Shah has repeatedly said: “Valuation is a point-in-time view. Focus on revenue, profits, and growth.”

This is not just startup talk. It’s a philosophy: money is a reflection of efficiency, not hype.

Philosophy 1: Mistakes Don’t Define You , Recovery Does

Kunal Shah often highlights that mistakes are not career-ending. What matters is how fast you recover.

FreeCharge was a huge success, but its coupon-driven model was not sustainable in the long term. Instead of being stuck in regret, Shah moved forward. CRED was built on trust and financial discipline, not just free handouts.

This philosophy applies to individuals as well. You are not the sum of your mistakes. You are the sum of how you bounce back.

Philosophy 2: Money Follows Efficiency and Respect for Time

Shah is obsessed with the value of time.

- “No country has become prosperous without becoming obsessed with time.”

- He points out that most Indians know their salary but don’t know their per-hour worth. This undervaluing of time holds back prosperity (Forbes India).

CRED’s model reflects this. Rewards are tied to efficiency , paying on time. Money is the byproduct of time respected.

For entrepreneurs and professionals, this is a clear takeaway: track your time like you track your money.

Philosophy 3: Ambition Over Status

One of Shah’s sharpest critiques of Indian society is our obsession with status. Fancy titles, flashy purchases, visible markers of success.

But he argues that substance creates wealth; status just burns it.

- “The average person’s ambition is extremely low for the opportunity and time they are born.”

- “They need to worry more about substance than status.”

CRED’s positioning reflects this: it’s exclusive, but not about status symbols. It’s about financial behaviour.

Shah believes money comes when you chase impact with ambition, not shallow validation.

Philosophy 4: Leadership Is Providing Certainty in Uncertain Times

Startups are storms. Markets swing, valuations fall, regulations change. In these moments, leaders matter most.

Shah’s view: “Ultimately leadership is about providing certainty in uncertain times.”

When CRED’s valuation dropped from USD 6.4 billion (2022) to USD 3.5 billion (2025), it could have been a crisis. Instead, Shah focused on strengthening revenue, cutting acquisition costs, and communicating clearly with his team and investors (Forbes India).

The philosophy here: money respects clarity. Investors and employees stay when leaders remove uncertainty.

Philosophy 5: Motivation + Efficiency = Wealth

Shah once explained: “The key ingredient for impact and wealth is combining motivation and efficiency.”

- Motivation alone = wasted effort.

- Efficiency alone = mechanical but uninspired.

- Together = innovation.

This is visible in CRED: users are motivated by rewards, but the system is efficient because it builds financial discipline.

For entrepreneurs, this is the formula to remember. Motivation without systems burns out. Systems without motivation rust. Together, they compound into wealth.

Philosophy 6: Work With Impatient Builders

Shah values impatience.

- “We like to work with people who are impatient, who want to get more things done in less amount of time.”

- Impatience signals hunger. It creates urgency, which drives progress.

In India’s slow-moving bureaucracy, impatience becomes an advantage. Money flows to those who build faster than the environment slows them down.

Challenges: Why Philosophy Mattered More Than Valuation

- Niche market: CRED was criticized for targeting only premium users. Shah’s philosophy of focusing on fewer but better customers proved right. By 2025, those customers created steady revenue streams.

- Valuation drop: From USD 6.4B to USD 3.5B. Instead of panic, Shah doubled down on efficiency and fundamentals.

- Skepticism: Many believed CRED was just a cashback app. Today, it is a broader financial ecosystem , lending, commerce, rewards.

Without philosophy, these could have been failures. With philosophy, they became turning points.

Key Takeaways: What We Can Learn From Kunal Shah

- Mistakes don’t define you. Recovery does.

Every failure is tuition for the next success. - Money follows time and efficiency.

Respect your hours, and money will respect you. - Chase ambition, not status.

Substance compounds. Status fades. - Leadership is certainty in chaos.

People trust leaders who stay steady when things shake. - Motivation + efficiency = wealth.

Fuel + engine. Both are needed. - Impatience is a competitive edge.

Move fast. Build faster. Don’t let slow systems slow you down.

The Philosophy Behind the Money

Kunal Shah’s achievements , FreeCharge’s ₹2,800 crore exit, CRED’s multi-billion-dollar valuation, his reputation as India’s most philosophical entrepreneur , are not accidents. They are outcomes of choices rooted in philosophy.

Money, in his world, is not the starting point. It is the scorecard of deeper principles: respect for time, recovery from mistakes, ambition with substance, clarity in leadership, and urgency in execution.

And for anyone building their own path, his message is clear:

Don’t chase money. Chase the behaviours that create it.

SOURCE:

- Wikipedia , Kunal Shah (Education, FreeCharge, CRED, background)

https://en.wikipedia.org/wiki/Kunal_Shah - Forbes India , “Entrepreneurship is not about glory, it is about judgement: CRED’s Kunal Shah”

https://www.forbesindia.com/article/startups/entrepreneurship-is-not-about-glory-it-is-about-judgement-creds-kunal-shah/96261/1 - Forbes India , “Valuation is a point-in-time view; focus on revenue, profits and growth: CRED’s Kunal Shah”

https://www.forbesindia.com/article/news/exclusive-valuation-is-a-pointintime-view-focus-on-revenue-profits-and-growth-creds-kunal-shah/96158/1 - Economic Times , Snapdeal acquires FreeCharge for ₹2,800 crore

https://economictimes.indiatimes.com/tech/technology/snapdeal-acquires-freecharge-in-indias-biggest-digital-deal/articleshow/46726319.cms - Inc42 , CRED FY24 revenue jumps 66% YoY, losses narrow

https://inc42.com/buzz/cred-fy24-revenue-jumps-66-yoy-losses-narrow/ - Lenny’s Newsletter , “Kunal Shah on winning in India, second-order thinking, and the future of fintech”

https://www.lennysnewsletter.com/p/kunal-shah-on-winning-in-india-second - Finowings , Success Story of Kunal Shah, CRED Founder

https://www.finowings.com/Success-Story/kunal-shah-cred-founder - YourStory , “Kunal Shah’s take on Indian startup ecosystem”

https://yourstory.com/2021/06/kunal-shah-cred-indian-startup-ecosystem - Moneycontrol , “CRED valuation drops to $3.5B in 2025 funding round”

https://www.moneycontrol.com/news/business/cred-valuation-drops-to-3-5-billion-in-2025-funding-round-12863791.html - The Economic Times , “CRED raises $80 million, valuation at $6.4 billion” (2022) https://economictimes.indiatimes.com/tech/funding/cred-raises-80-million-at-6-4-billion-valuation/articleshow/91067156.cms

- Apple Podcasts , Kunal Shah of CRED on “Exciting but painful journey” (philosophy, efficiency, time obsession) https://podcasts.apple.com/in/podcast/kunal-shah-of-cred-on-exciting-but-painful/id1639125773?i=1000606521783